What Should You Look For In A Commercial Insurance Company?

Choosing the right commercial insurance company is a pivotal decision for any business. The insurer you select will play a crucial role in safeguarding your assets, managing risks, and ensuring business continuity. Given the complexities of modern business environments, it’s essential to partner with an insurer that aligns with your specific needs and industry requirements.

Key Takeaways

- Prioritize Financial Stability: Ensure the insurer has strong ratings from independent agencies like A.M. Best and Moody’s.

- Choose Industry Expertise: Look for a company with experience in your specific industry to receive tailored advice and solutions.

- Demand Comprehensive Coverage: The best insurers offer a wide range of customizable policies suited to your evolving needs.

- Evaluate the Claims Process: A quick, fair, and transparent claims system is critical during emergencies.

- Ensure Regulatory Compliance: Work with licensed insurers who comply with national standards and local laws.

- Embrace Tech-Savvy Insurers: Digital platforms for policy management and claims streamline your experience.

- Think Long-Term: Select a provider that grows with your business and acts as a strategic partner.

Financial Strength and Reputation (Expanded)

An insurer’s financial standing is a direct reflection of its ability to pay claims, especially during high-stress economic events such as natural disasters or market downturns. Choose a company that consistently earns strong ratings from agencies like:

- A.M. Best – Specializes in the insurance industry.

- Moody’s and S&P Global Ratings – Evaluate credit risk and financial stability.

Case Example: During Hurricane Katrina, insurers with strong balance sheets were able to respond to claims quickly, while others delayed payments or failed to cover damages due to financial instability.

Additionally, consider online reviews, Better Business Bureau (BBB) ratings, and industry reputation. Don’t just look for 5-star ratings—read the negative reviews to see if there’s a pattern in complaints, especially concerning claims denial or customer service.

Industry Expertise and Specialization

A commercial insurance company’s familiarity with your industry ensures they understand not just the common risks, but also the nuanced, less obvious ones.

For example:

- A construction firm needs coverage for equipment, contractor liability, and workplace injuries.

- A tech startup must consider intellectual property protection and cyber liability insurance.

- A healthcare facility faces unique legal and compliance risks, requiring malpractice coverage and HIPAA compliance support.

Ask your insurer if they have dedicated teams or underwriters who specialize in your industry. Their experience can significantly influence how well they craft policies that mitigate both traditional and emerging risks.

Comprehensive Coverage Options

Commercial insurance is not a one-size-fits-all product. A credible insurer should offer a wide range of policies and have the ability to bundle or tailor them to your business needs.

At a minimum, look for providers that offer:

- General Liability Insurance: Covers third-party bodily injury and property damage.

- Commercial Property Insurance: Protects your business property, including equipment, buildings, and inventory.

- Business Interruption Insurance: Helps replace lost income if your business is forced to close temporarily.

- Cyber Liability Insurance: Essential for businesses vulnerable to data breaches and cyberattacks.

- Workers’ Compensation: Required in most jurisdictions to cover employee injuries and medical expenses.

- Professional Liability (Errors and Omissions): Especially important for service providers who may face negligence claims.

- Commercial Auto Insurance: Covers vehicles owned or used by the business.

A good insurer will be able to combine these into cost-effective Business Owner Policies (BOPs) or create customized packages that address your specific risks.

Customization and Flexibility (Expanded)

Every business has different exposures and risk profiles. For instance, a retailer with multiple storefronts may need a vastly different insurance package compared to a remote consultancy.

A quality insurance provider should be able to:

- Customize deductibles based on your financial tolerance for risk.

- Offer endorsements (policy add-ons) specific to your needs.

- Adjust policy limits as your business grows or scales down.

- Reassess and revise your coverage annually or after major changes.

Consider this scenario: A small restaurant owner may begin with basic general liability and property coverage. As the business grows and introduces alcohol service, liquor liability and spoilage coverage may become necessary. Insurers that offer flexible, modular coverage can make these transitions smooth and cost-effective.

Transparent Pricing and Cost-Effectiveness

Premiums should not be the only factor in choosing an insurance provider. In many cases, a higher premium may reflect broader coverage, better claims service, or faster payouts.

However, pricing should always be transparent.

Use this checklist to assess pricing clarity:

- Are all parts of the policy clearly itemized?

- Are taxes, commissions, and broker fees disclosed upfront?

- Is there a clear explanation of how claims affect future premiums?

- Does the provider explain the trade-offs between different coverage limits or deductibles?

To make a well-informed choice, request quotes from at least three insurers. If possible, consult a licensed broker who can explain differences in coverage and value. A trustworthy broker will help you determine which premiums are justified and which features you can live without.

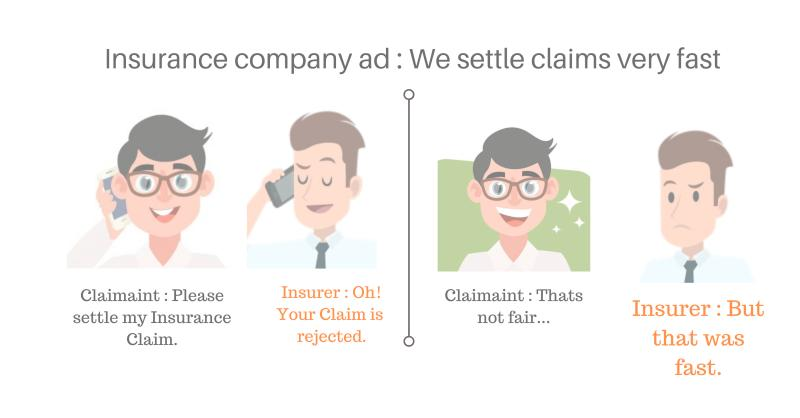

Efficient Claims Process

The value of insurance becomes most evident when you file a claim. A slow or opaque claims process can turn a difficult situation into a crisis.

A good insurance company will offer:

- A 24/7 claims hotline or online portal

- Digital claims submission and documentation

- Real-time claim tracking and status updates

- Dedicated claims handlers for your case

Watch out for red flags such as:

- A high number of unresolved customer complaints

- Lack of digital tools or mobile support

- Poor communication or delays in payout

Some insurers, like Hiscox and Chubb, are frequently praised for their efficient, user-friendly claims processes, often offering mobile apps for instant updates and quicker resolution.

Customer Service and Support

Your insurer should be a year-round partner, not just a point of contact when something goes wrong.

Assess their support capabilities by considering:

- How accessible are they (via phone, email, live chat)?

- Do they offer dedicated account managers who understand your business?

- Are the support agents trained to assist with your specific industry?

- Do they provide value-added services like business continuity planning?

Quality insurers will also offer educational resources such as:

- Risk mitigation guides

- Safety templates

- Webinars and toolkits tailored to your industry

Support like this can help reduce claims in the first place and keep your operations running smoothly during disruptions.

Regulatory Compliance and Licensing (Expanded)

Confirm that your chosen insurer is:

- Licensed to operate in your state or country

- Compliant with national insurance regulations (e.g., IRDAI in India, NAIC in the U.S.)

- Willing to provide regulatory documents upon request

Why it matters: In case of disputes, working with a licensed insurer ensures your complaint can be escalated to a regulatory authority.

Technological Capabilities (Expanded)

Insurers that leverage tech offer:

- Mobile apps for policy management

- Automated renewals

- AI-driven risk assessments

- Online document uploads and e-signatures

Example: Lemonade and NEXT Insurance are examples of insurers that use AI and machine learning to process claims in minutes, drastically improving customer experience.

Long-Term Partnership Potential (Expanded)

The best commercial insurers are proactive, not reactive. They offer:

- Annual risk assessments

- Premium reviews

- Tailored updates based on business growth

- Early warning systems for emerging threats

Tip: Build a relationship with a provider that doesn’t just renew your policy each year but actively helps you reduce risk and save money over time.

Evaluate the Insurer’s Risk Management Support

A top-tier commercial insurance company does more than just sell policies—it helps you proactively manage and reduce risks. This is especially important for businesses in industries like manufacturing, logistics, and construction, where operational hazards can be significant.

Key Elements to Look For:

- Risk Assessments: Do they offer free on-site or virtual evaluations to identify vulnerabilities?

- Safety Training: Some insurers provide access to online training platforms for employee safety.

- Compliance Audits: Are they helping you stay compliant with OSHA, HIPAA, or GDPR?

- Business Continuity Planning: Do they offer templates, tools, or expert consulting to help you build a recovery strategy?

Example: A manufacturing business working with an insurer that provides quarterly risk assessments may benefit from premium discounts and fewer workplace injuries, directly affecting profitability.

GlobGlobal Reach vs. Local Expertise

The right insurer should align with the geographic scope of your business. Whether you’re operating in one city or across multiple countries, choosing between a global insurer and a regional specialist can significantly affect your coverage experience.

Global Insurers

Advantages:

- Operate across countries and regions

- Offer standardized policies for international consistency

- Useful for businesses with global supply chains, overseas clients, or international offices

Challenges:

- Claims processing may be centralized and slower

- Less flexible in customizing policies to local regulations

- May not fully understand specific regional risks or legal nuances

Local/Niche Insurers

Advantages:

- Deep understanding of local laws, regulations, and cultural business practices

- Typically more responsive and flexible

- Often provide personalized service and quicker claims processing

Challenges:

- Limited geographic coverage

- May not support business expansions into other regions or countries

- Smaller resource pool compared to global firms

Best Practice:

If your business is expanding globally, choose a large insurer with local offices or partnerships. This offers the best of both worlds: broad reach and localized service.

In-House Legal and Compliance Teams

Legal issues are an inevitable part of doing business, especially in regulated industries. Some commercial insurance providers add extra value by offering legal support services under certain policies—an often overlooked but critical benefit.

Common Legal Services Offered by Insurers:

- Pre-claim Legal Advice: Preventive consultations before filing a claim or when a legal issue arises.

- Regulatory Representation: Support during audits or government investigations.

- Contract and Document Review: Risk assessment for agreements with vendors, clients, or partners.

- Litigation Support: Direct representation or coverage of legal fees under liability policies.

Example Scenario:

A digital marketing firm was sued for copyright infringement after using a third-party image in a campaign. Their insurer’s in-house legal team intervened early, negotiated with the claimant, and secured a confidential settlement—all covered under the company’s Errors and Omissions (E&O) policy. This avoided a drawn-out court battle and protected the firm’s reputation.

Why It Matters:

Access to in-house or affiliated legal teams can save businesses thousands in legal fees and minimize operational disruptions during disputes.

Scalability and Policy Portability

Your insurance coverage should grow with your business—without requiring you to start from scratch each time you expand. A scalable and portable policy setup reduces both administrative overhead and operational risk.

Key Features of Scalable Insurance:

- Policy Scalability: Allows for easy increases in coverage limits, asset protection, or employee coverage as your business grows.

- Portability Across Locations: Lets you extend or transfer policies across state lines or international borders with minimal red tape.

- Group Coverage Extensions: Seamless integration of new employees, partners, or business units into existing group policies.

Example:

A SaaS startup that begins in a shared workspace may eventually open offices in San Francisco, Austin, and Toronto. A scalable insurer will allow the company to add new physical locations and update employee headcount without undergoing new underwriting processes or facing sudden premium spikes.

Additional Benefits to Look For:

- Adjustability of coverage types (e.g., adding cyber insurance as operations digitize)

- Automatic policy updates based on growth milestones (e.g., revenue or employee thresholds)

- Integration with HR systems for updating workforce-related coverages

Why It Matters:

Business growth should not be hindered by outdated or rigid insurance policies. The right provider will support your trajectory—not limit it.

Real Client Case Studies

Let’s look at two businesses and how their choice of insurance provider made a difference.

Case Study 1: Small E-commerce Business

Challenge: A Shopify-based store faced a data breach that exposed thousands of customer records.

Insurance Partner: The company had cyber liability insurance with a provider known for rapid incident response.

Outcome: Within 48 hours, legal support, PR guidance, and customer notification services were deployed. The total loss was mitigated to 20% of initial estimates.

Case Study 2: Commercial Real Estate Firm

Challenge: A fire damaged one of their properties during a tenant renovation.

Insurance Partner: Their commercial insurer offered both property and business interruption coverage.

Outcome: Repairs were covered in full, and the lost rental income was reimbursed for 6 months, keeping the company solvent.

Testimonials and Third-Party Endorsements

Social proof can be powerful. Beyond online reviews, look for:

- Client testimonials on the insurer’s website

- Awards from industry associations

- Endorsements by trade groups or chambers of commerce

- Recognition in trade publications

These indicators show that the insurer is trusted not just by customers but by the broader business community.

How to Vet an Insurer: Step-by-Step Process

Step 1: Define Your Needs

List out all the potential risks your business faces. Include regulatory requirements, asset coverage, liability exposure, etc.

Step 2: Research Providers

Use industry reports, rating agencies, and professional networks. Ask peers in your industry.

Step 3: Shortlist Top 3-5 Insurers

Compare services, prices, support, claims processes, and technology.

Step 4: Request Proposals and Quotes

Ask for detailed proposals with sample scenarios. Evaluate how well they understand your business.

Step 5: Ask Questions

Ask about exclusions, claims denial rates, coverage limits, hidden costs, and scalability.

Step 6: Check Credentials

Verify licenses, regulatory standing, and complaint history with your state’s insurance department or regulator.

Step 7: Make a Decision

Choose the provider that offers the best combination of coverage, support, financial strength, and long-term value.

Working with Insurance Brokers vs. Direct Insurers

Insurance Brokers:

- Represent you, not the insurer

- Access to multiple providers and plans

- More negotiation power

- Useful for complex or high-value risks

Direct Insurers:

- Typically cheaper

- Faster onboarding

- More streamlined communication

Tip: For growing or specialized businesses, brokers can unlock better deals and help navigate complex risk profiles.

Red Flags to Avoid

Be cautious if the insurance company:

- Avoids giving detailed policy documents before signing

- Is vague about what’s not covered (exclusions)

- Has a long history of claims disputes

- Offers “too good to be true” low premiums

- Doesn’t have a clear renewal process

- Is not transparent about broker commissions

Future Trends in Commercial Insurance

Stay informed about these trends when choosing an insurer:

- Usage-based Insurance: Policies that adapt based on real-time behavior or usage (popular in fleet insurance).

- Embedded Insurance: Insurance bundled within business platforms (e.g., Shopify or Amazon sellers).

- Parametric Insurance: Payouts triggered by a predefined event (e.g., earthquake intensity, rainfall level).

- ESG-Aligned Policies: Insurers are offering discounts or tailored policies for sustainable and socially responsible business.

Also Read:- What Are The Best Insurance Plans Available Right Now?

Conclusion

Choosing the right commercial insurance company is a foundational decision that can significantly impact your business’s long-term success and stability. Insurance is not merely a legal obligation or a financial safeguard—it’s a strategic tool that protects your operations, assets, employees, and reputation from unforeseen risks.

The ideal insurance provider should combine financial strength, deep industry expertise, comprehensive and customizable coverage options, and exceptional customer service. It should also have a transparent claims process and use technology to make your insurance experience more efficient. Ultimately, you’re looking for a partner that can evolve with your business and help you mitigate risks proactively rather than reactively.

Take your time to research, ask the right questions, compare options, and seek guidance if needed. A strong relationship with a reliable commercial insurance company is an investment in the resilience and continuity of your business.

FAQs

- What types of commercial insurance should my business consider?

- The types of insurance depend on your industry and specific needs. Common types include general liability, property insurance, workers’ compensation, professional liability, and cyber liability.

- How can I assess an insurance company’s financial stability?

- Consult independent rating agencies like A.M. Best, Moody’s, and S&P Global Ratings. These agencies provide ratings that reflect the financial strength and creditworthiness of insurance companies.

- Is it better to choose a local or national insurance provider?

- Local providers may have a better understanding of regional risks and regulations. However, national providers might offer a broader range of coverage options. Consider your business’s specific needs when making this decision.

- How often should I review my insurance policy?

- It’s advisable to review your insurance policy annually or whenever significant changes occur in your business, such as expansion, new product lines, or entering new markets